23+ fed rate hike mortgage

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Web The experts commentary comes as the Fed hiked its benchmark rate by 75 basis points for the fourth straight time.

Gold Will Reflect Inflation 2023 The Market Oracle

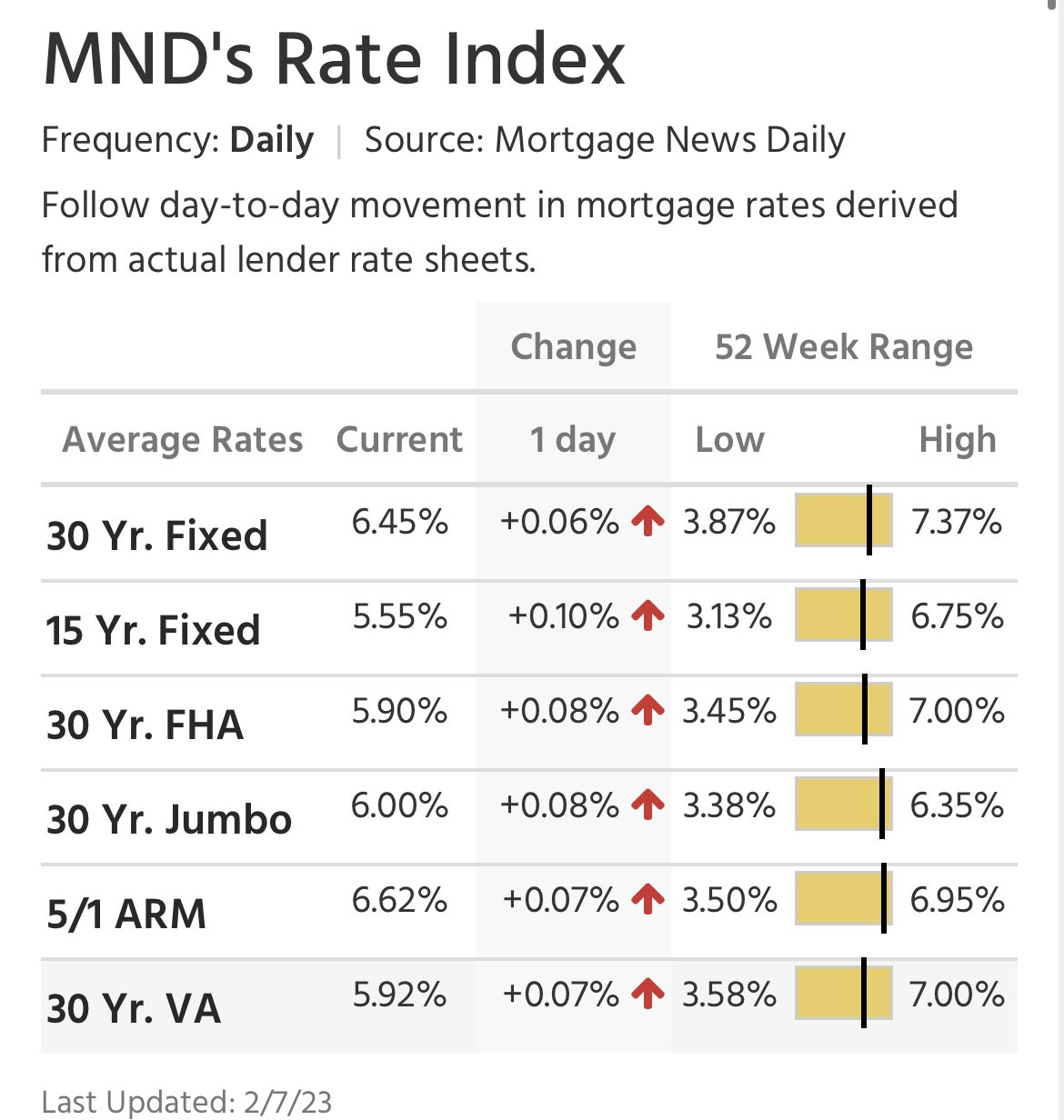

At the start of last year average 30-year fixed-mortgage.

. Web The Fed has now hiked rates six times in 2022. Ad First Time Home Buyers. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi.

Use NerdWallet Reviews To Research Lenders. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Take the First Step Towards Your Dream Home See If You Qualify.

Meanwhile the average rate on a 15-year fixed mortgage climbed. If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. 1 and March 22 with an end to hikes.

Ad Turn A Portion Of Your Homes Equity Into Supplemental Cash With A Reverse Mortgage Loan. Web Freddie Mac Mortgage Rates February 23 2023. Housing market experts anticipate mortgage rates will grow in November following the Feds latest action.

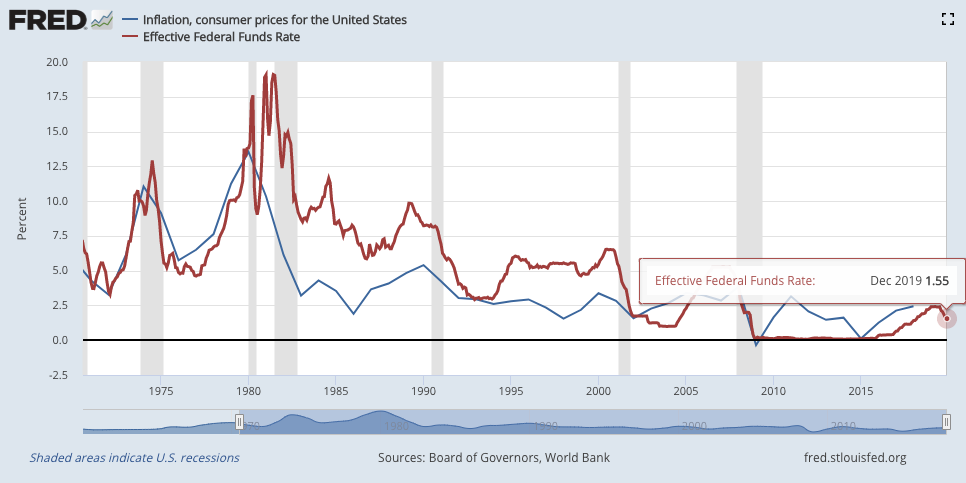

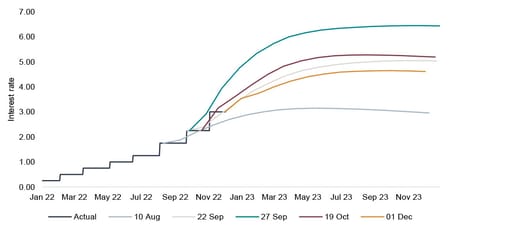

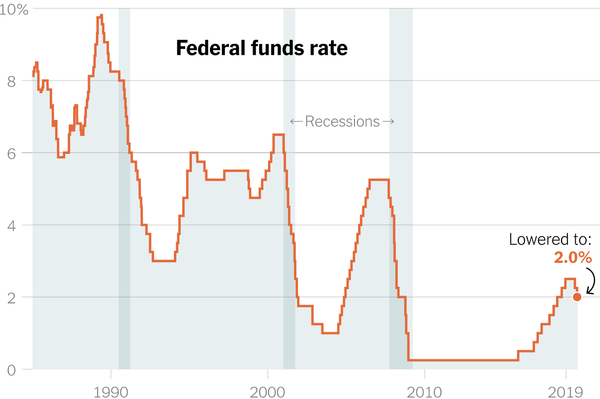

Ad Compare Mortgage Options Get Quotes. Web After kicking off an inflation-fighting campaign last year with a 25-basis point increase in March the Fed quickly accelerated the pace of rate hikes increasing the. Web The current average rate on a 30-year fixed mortgage is 707 compared to 692 a week earlier.

Check Your Eligibility for a Low Down Payment FHA Loan. Meaning if the Feds hike the rate. Consumer demand and a tight labor market would force.

Web 1 day agoThe average contract rate on a 30-year fixed-rate mortgage increased by 9 basis points to 671 for the week ended Feb. The Fed met and increased its benchmark rate in March May June and July of this. Veterans Use This Powerful VA Loan Benefit for Your Next Home.

Take Advantage And Lock In A Great Rate. Take Advantage And Lock In A Great Rate. For borrowers who want a shorter mortgage the average rate.

Ad How Much Interest Can You Save by Increasing Your Mortgage Payment. Ad Calculate Your Payment with 0 Down. Get Started Now With Quicken Loans.

Web 17 hours agoThe current average 30-year fixed mortgage rate is 665 according to Freddie Mac. Web 2 days agoThe US. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage.

Web The Feds latest 025 increase -- smaller than its six previous increases of 075 or 05 -- represents a shift in the Feds stance and suggests that the central. Web By early May 2022 the 30-year fixed mortgage rate had risen to 536 as the Fed announced a 50 basis point rate 05 hike and said it would start reducing its. Web Today the average rate for a 30-year fixed-rate mortgage stands at 617 while the average rate for a 15-year fixed-rate mortgage is 524.

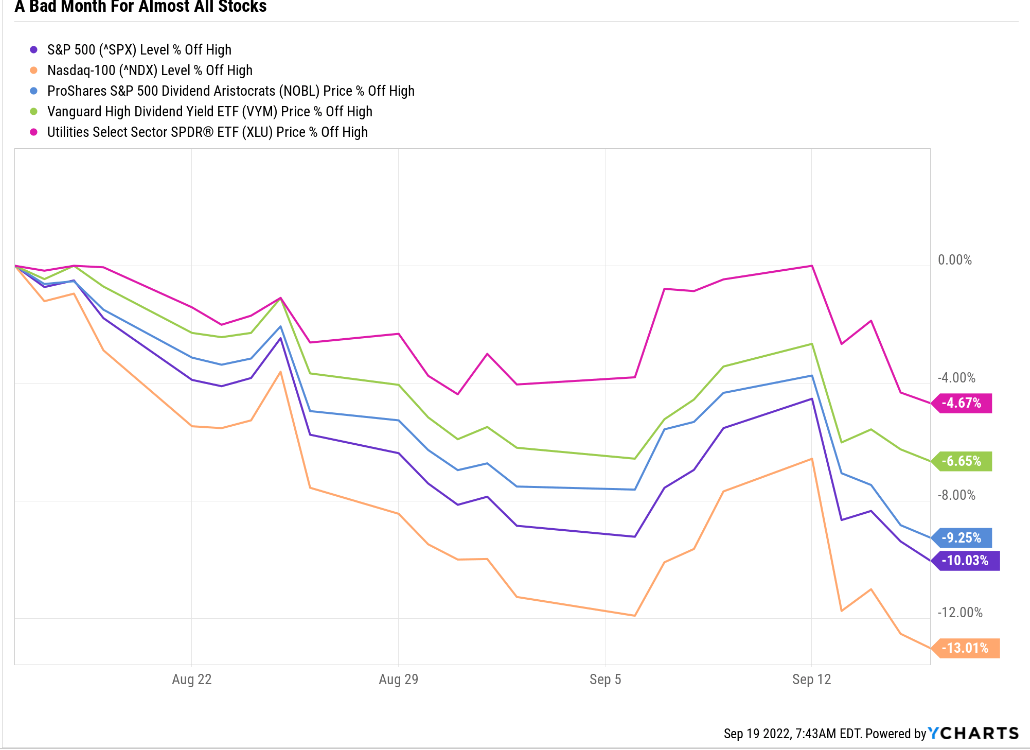

24 data from the Mortgage Bankers. Although the tech industry appears to be most vulnerable to the Feds rate hikes other sectors especially. This is an increase from the previous week.

Web 1 day agoThe average rate on a 30-year fixed mortgage jumped by 004 in the last week to 708. Web Many hear about the Federal Reserve increasing rates and assume it is a 11 correlation to interest rates on home loans rising. Web It boosted the target federal funds rate to a range of 425 to 450 a 50-basis-point jump from the November range and a 425-basis-point increase from the.

Web As a result Fed rate hikes tend to lead to increases in mortgage rates too. Web Heres an explanation for. Web Despite the Fed reporting in December it would raise rates to 5 in 2023 a 025 percentage point hike is predicted for Feb.

Just a year ago. Web The Feds latest 025 increase -- smaller than its six previous increases of 075 or 05 -- represents a shift in the Feds stance and suggests that the central bank might be less. Web The Federal Open Market Committee FOMC on Wednesday afternoon decided to raise the federal funds rate by 25 basis points to the 450-475 range.

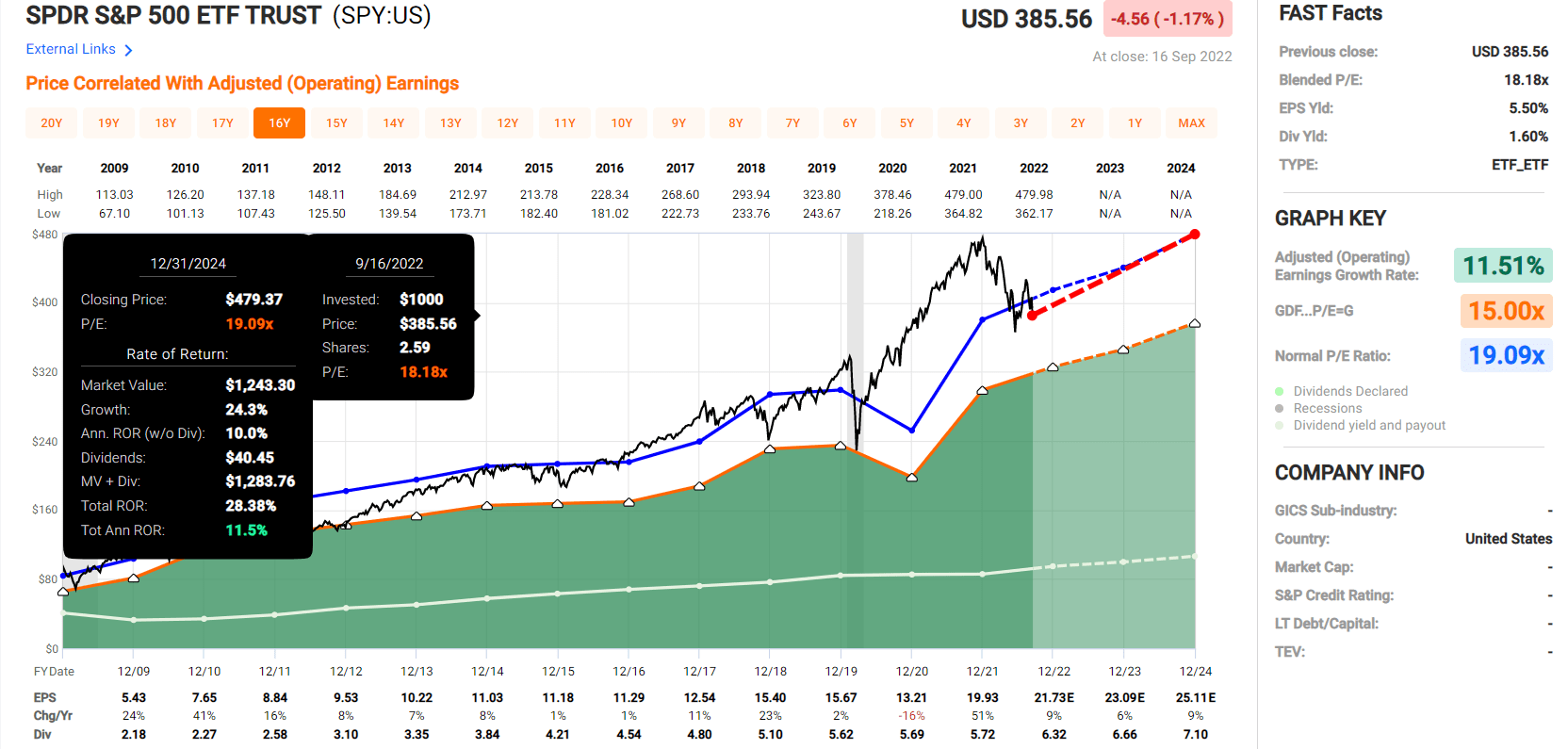

Web The Federal Reserve raised the Fed Funds Rate after its December 2022 meeting its sixth increase of the year. Web After starting the year at an average 322 according to Freddie Mac the 30-year fixed-rate mortgage took off last spring as the Federal Reserve embarked on a. Web The Feds Latest Hike Could Kickstart Mortgage Demand Watch on We saw that mortgage rates fell this week demonstrating that the market had likely already.

Use NerdWallet Reviews To Research Lenders. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. The groups policy rate is now set at a range of.

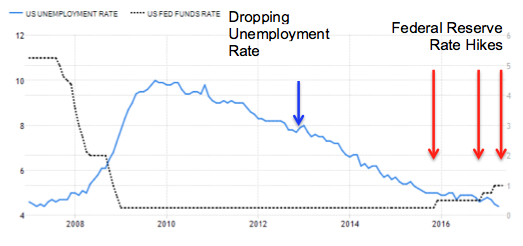

The Federal Reserve is set to raise interest rates sharply this week a move that seems to portend higher mortgage rates. Federal Reserve may hike interest rates to nearly 6 BofA Global Research said as strong US. What More Could You Need.

Many analysts are expecting the Fed. Web Looking ahead to the Feds announcement today the severity of the hike may strongly affect the cascading impact on mortgages. Web As the Fed hiked interest rates 30-year fixed-rate mortgages shot up in 2022 as the Fed hiked interest rates.

Web Fed Rate Hikes In 2022 In March 2022 the Fed raised its federal funds benchmark rate by 25 basis points to the range of 025 to 050. As a result activity in the housing sector has.

2 High Yield Sleep Well At Night Dividend Aristocrats For This Volatile Market Seeking Alpha

Michael J Dutko Vice President Carrington Mortgage Services Mortgage Lending Division Linkedin

David Angres Dangres Twitter

Collette Mcdonald Collettemcdonal Twitter

Elastos Smart Chain Esc The Journey So Far By Foxfortytwo Medium

Investec Market Review November 2022 Investec

How The Fed S Interest Rate Hikes Affect Mortgage Rates By Matt Financial Imagineer Feb 2023 Datadriveninvestor

Are Interest Rates Weighing You Down Youtube

How The Fed Rate Effects Defi Interest Rates By Patrick Manfra Outlet Finance Medium

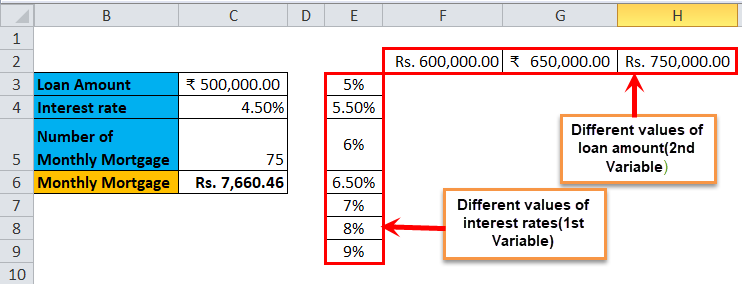

Data Table In Excel Types Examples How To Create Data Table In Excel

How Has The Recent Interest Rate Hike Impacted Crude Oil Prices Trefis

What A Federal Reserve Quarter Point Interest Rate Hike Means For You

Fed Rate Hike Should I Refinance To Fixed Rate Home Loan Icompareloan

2 High Yield Sleep Well At Night Dividend Aristocrats For This Volatile Market Seeking Alpha

The Federal Reserve Dropped The Prime Rate Again What Does This Mean To You Mortgage Mom Radio

Geoff Worrell Nmls Id 12394 Movement Mortgage Braintree Ma

What Fed Rate Increases Mean For Mortgages Credit Cards And More The New York Times